Annex

Resources + Research

In what seems like a constantly-changing financial world, you can trust Annex Wealth Management’s commitment to creating education and information designed to help you understand what’s important and worth your focus.

Latest R+R:

Most people know that waiting to start drawing benefits typically leads to a bigger monthly check, but many don’t want to wait right now. According to a recent article from The Wall Street Journal, fear may be driving that decision. Eric Strom, CFP®, EA is here to discuss.

![[ConCom] Equity Compensation_202505_1649530127 (0;00;15;16)](https://annexwealth.com/wp-content/uploads/2025/05/ConCom-Equity-Compensation_202505_1649530127-0001516.jpg)

Here, we’re going to cover something that could be critical for many professionals: equity compensation. From Restricted Stock Units, or RSUs, to Non-Qualified Stock Options, or NQSOs, these benefits can be a game-changer. You’ll hear of them in industries like tech, healthcare, and finance. To help us unwind this, joined by Tom Berkholtz, a Senior Financial Planner at Annex.

![Video_[ConCom] Should You Sell in May and Go Away- Probably Not_202505_1650254622 (0;00;07;20)](https://annexwealth.com/wp-content/uploads/2025/05/Video_ConCom-Should-You-Sell-in-May-and-Go-Away-Probably-Not_202505_1650254622-0000720.jpg)

Annex Wealth Management’s Matthew Morzy, CFP® and Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE discuss how the Wall Street adage to ‘Sell in May and Go Away’ came to be and whether or not it’s still good advice.

![Spring Cleaning Investment ONE [ConCom]_202404_1641239243 (0;00;16;05)](https://annexwealth.com/wp-content/uploads/2025/04/Spring-Cleaning-Investment-ONE-ConCom_202404_1641239243-0001605.jpg)

Along with washing your windows and vacuuming under the sofa this spring, take some time to tidy up your portfolio. We’ve rounded up tips to declutter, simplify and make sure everything is in its place.

Brandon Lehman, CFP®, AIF® is the Director of Annex Private Client at Annex Wealth Management, as well as a Civil Affairs Officer for the US Army Reserves. As a member of the Armed Forces, he’s familiar with the phrase ‘high speed, low drag’ – where special forces focus on streamlined efficiency to get the job done. Brandon joins us to discuss how we employ that mindset with our Annex Private Clients – focusing on the unique needs of Affluent Families, Trailblazers, Current and Former Physicians, Multi-Generational Family Business Owners, and Executives.

![[ConCom] Business Transitions_202501_1574320451 (0;00;23;18)](https://annexwealth.com/wp-content/uploads/2025/04/ConCom-Business-Transitions_202501_1574320451-0002318.jpg)

Selling a business or transitioning out is a significant financial and emotional event. Annex Wealth Management’s Chief Economist, Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE is here to discuss.

Estate Planning can be described as getting the RIGHT PROPERTY to the RIGHT PEOPLE at the RIGHT TIME and in the RIGHT WAY. Amy Kiiskila is here to discuss what you need to know – in order to get that done.

For many, some of our best memories is at the summer place. Could be a family cottage, lake house, or cabin. Those places are near and dear to us, and often, there is a strong desire to keep those special places in the family. It’s easier said than done. When the time comes to assign new ownership and responsibility, good planning pays off.

Many people wish to pass assets upon death to their family, often their children. That can get complicated quickly when the family in question is blended. It’s important to make sure that an estate plan aligns with goals and intended beneficiaries. Estate Planning Attorney, Alec Durand, JD is here to discuss.

![[ConCom] Asset Rich Cash Poor_202503_1618193652 (0;01;46;09)](https://annexwealth.com/wp-content/uploads/2025/04/ConCom-Asset-Rich-Cash-Poor_202503_1618193652-0014609.jpg)

Annex Wealth Management’s Brian Lamborne, JD, LLM discusses the upsides and downsides of being asset rich and how to unlock cash from your assets without losing ownership when the time comes.

![[ConCom] Diversified distribution planning_202502_1600708488 (0;00;18;19)](https://annexwealth.com/wp-content/uploads/2025/04/ConCom-Diversified-distribution-planning_202502_1600708488-0001819.jpg)

Diversifying your retirement savings means spreading it across a mix of investments so it’s not too concentrated in any single investment. Where to start depends on several factors, including your current tax bracket, future tax expectations, and your overall financial goals. Annex Wealth Management’s Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE is here to discuss.

![[ConCom] Investing Diversification_202503_1600670770 (0;00;32;12)](https://annexwealth.com/wp-content/uploads/2025/04/ConCom-Investing-Diversification_202503_1600670770-0003212.jpg)

Annex Wealth Management’s Matthew Morzy, CFP® joins us to discuss how diversification works, the different levels of diversification, and how Annex works with clients to ensure their portfolios are working towards their goals.

Nearly half of private-sector workers are saving in 401(k)s for the first time. Annex Wealth Management’s Tom Parks is here to talk about the key factors that are driving this as well as the future of 401(k)s.

Emotion and investing aren’t great partners, especially when the market is volatile. We like when things go up. Some might be fine stomaching a 20% pullback – but others have trouble with a 6% dip. We understand that. Annex Wealth Management’s Chief Economist, Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE and Director Of Research, Matthew Morzy, CFP® are here to discuss.

![[ConCom] Passion Assets 2025_202502_1599934877 (0;00;16;16)](https://annexwealth.com/wp-content/uploads/2025/03/ConCom-Passion-Assets-2025_202502_1599934877-0001616.jpg)

A car collection. Art collection. Wine collection. Along the way in the thing called life, we collect things that have value that aren’t necessarily in the category of investments like stocks, bonds, mutual funds, property, etc. They are Passion Assets. It can be complicated—unless you’re working with a team who understands them.

We have two of our Annex teammates to talk about Passion Assets and how we assist in planning for their distribution.

Maybe you’re one of the 4.1 million Americans turning 65 this year. Maybe you’re hoping to take an early exit from the work force, or you’ve pushed off your retirement date to ensure you’re truly ready. Whatever your situation, it will help if you can answer “yes” to these seven questions.

![[ConCom] Key Person insurance_202501_1574243506 (0;00;07;13)](https://annexwealth.com/wp-content/uploads/2025/03/ConCom-Key-Person-insurance_202501_1574243506-0000713.jpg)

Eric Strom, CFP®, EA is here to discuss life insurance, but from a business owner perspective. Most of us understand life insurance as something that provides financial support to ease transitions, specifically during loss. It can fill vital gaps in income and save families from financial hardship. But it can also play a crucial role in succession and exit planning.

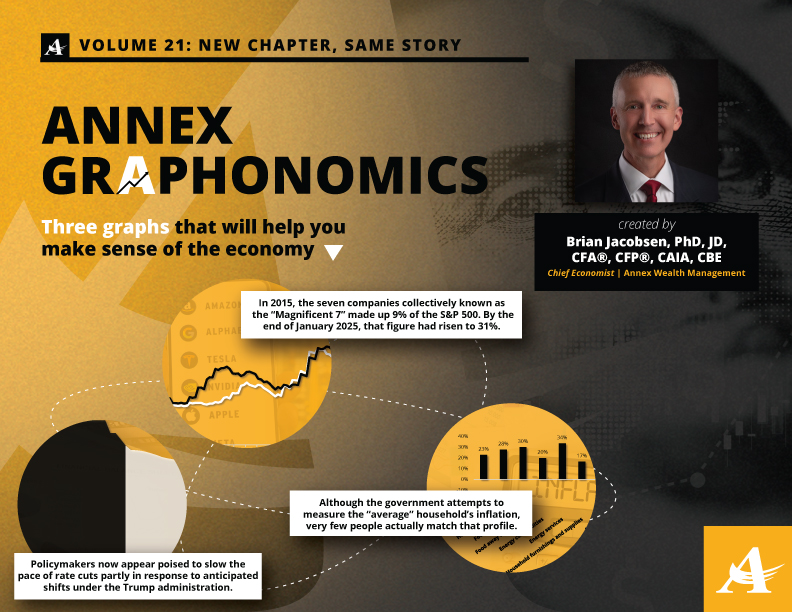

Graphonomics: Volume 21

Maybe you’re in a late-stage career. You’ve been saving and investing. Racked up a nice pile of various funds. Got some big plans for retirement, too. Time to dream and time to plan. Cash Flow Modeling may be a valuable tool in your planning toolbox to aid in that plan. Cory Borcherdt is here to discuss.

Tax laws are changing. How can you plan to pay less taxes in retirement? Arabella Parins, CFP® is here to discuss Social Security claiming strategies, Roth conversions, contribution planning, Health Savings Accounts, and charitable giving (QCDs).

Annex Wealth Management’s Financial Planning Specialist, Jenny Jesse, CFP®, EA covers what you need to know when it comes to Roth Conversions – what they are, the potential benefits, and different types. Roth conversions can be complex. They cannot be undone so it’s important to consider all factors – and work with a trusted advisor.

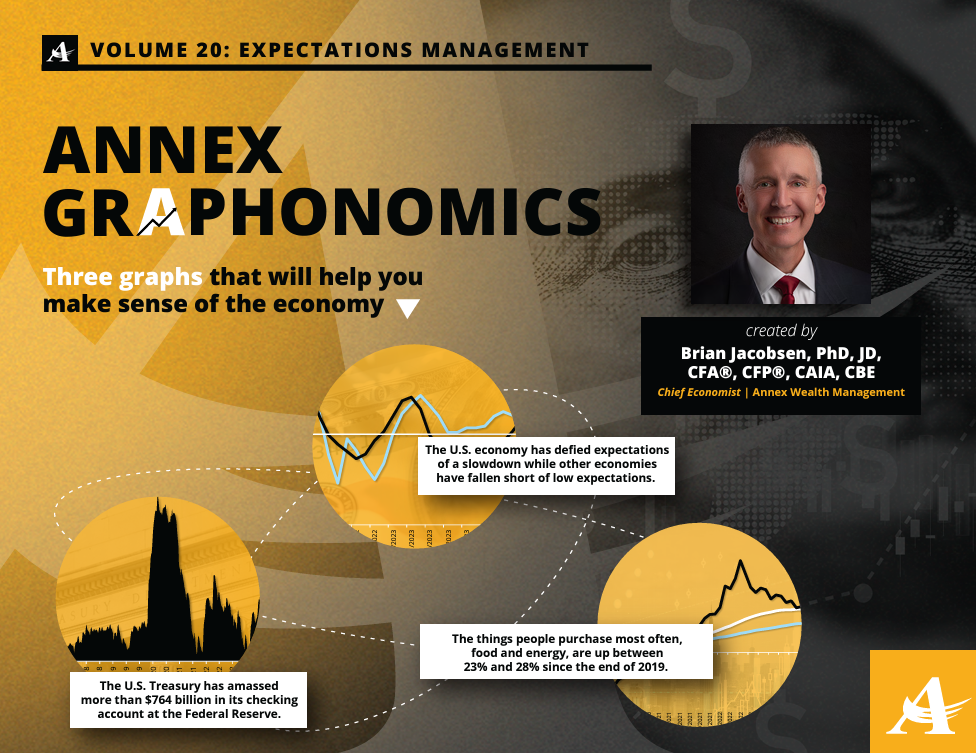

Graphonomics: Volume 20

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on trade perspectives.

1) When Exceptionalism Is The Rule. 2) People Feel Prices More Than Inflation. 3) The Debt Ceiling Clock Ticks Quickly.

It happens. From full-ride scholarships to a change of plans – what’s your Plan B if the money you saved for your child’s education isn’t needed?

The legendary Warren Buffett created some talk recently by sharing his wisdom regarding estate planning. Most estimates of his net worth put him just north of $150 billion. He knows he can’t take it with him. Some things he said generated headlines.

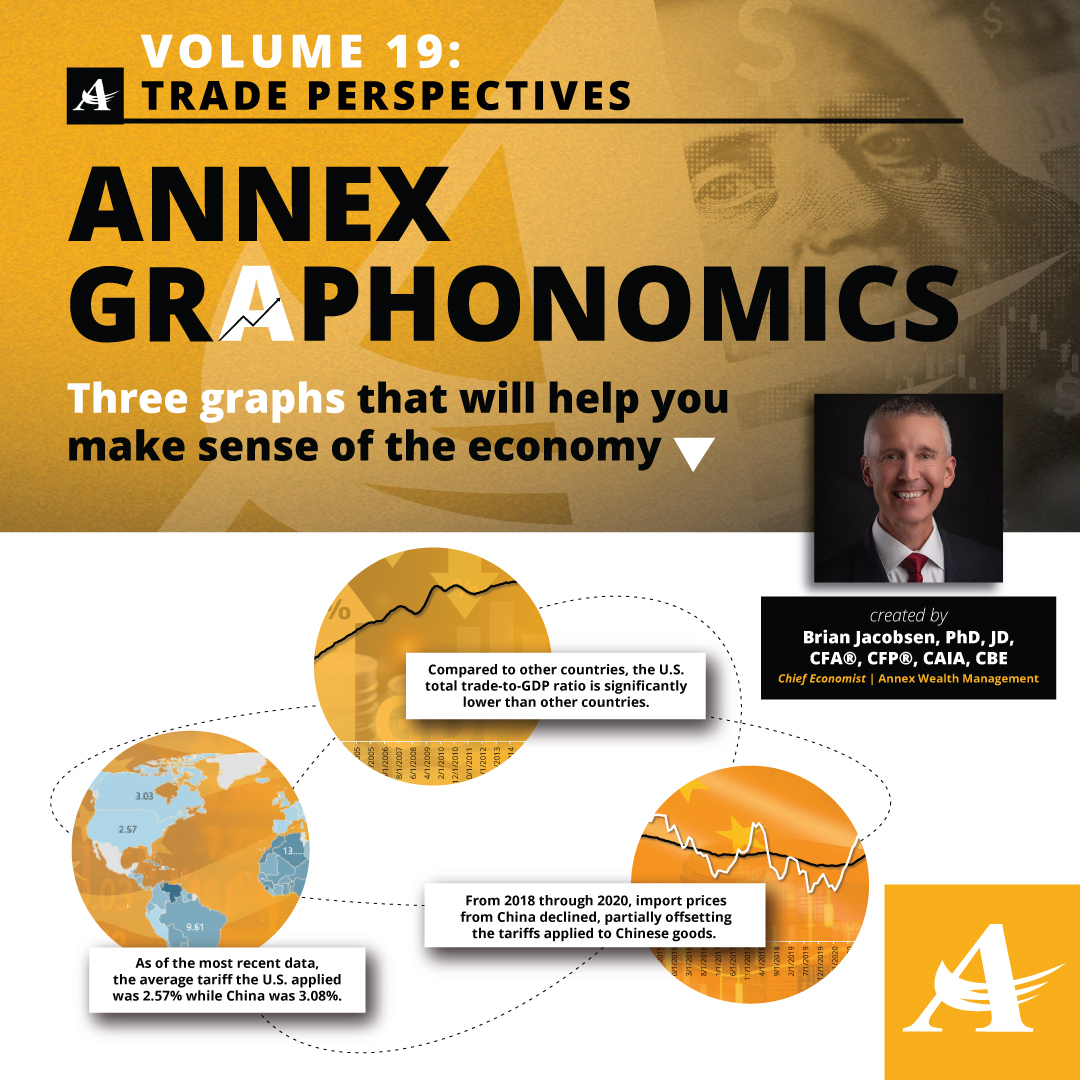

Graphonomics: Volume 19

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on:

1) Growth: Dependency on China. 2) Inflation: Tariffs and Inflation. 3) Policy: Tariffs: Threat or Tool?

Being rich implies spending; becoming wealthy implies a permanent and sustainable condition of financial independence. What are 10 lessons to learn from both the rich and wealthy? None are impossible. Some seem impossibly easy.

A group of Americans aged 70-80 were asked “What is your biggest retirement regret?” Here’s what they had to say.

The “4% rule” is an often-cited rule of thumb for how much retirees should withdraw from their retirement savings each year to ensure their savings last. However, in the decades since the strategy was created, retirement planning has changed.

Choosing A President: Potential Impacts On Your Financial Plan

From the earliest days of our country’s history, negative speculation has been a part of the American election year. See what Annex, and history, has to say about the potential impacts of an election on your financial plan.

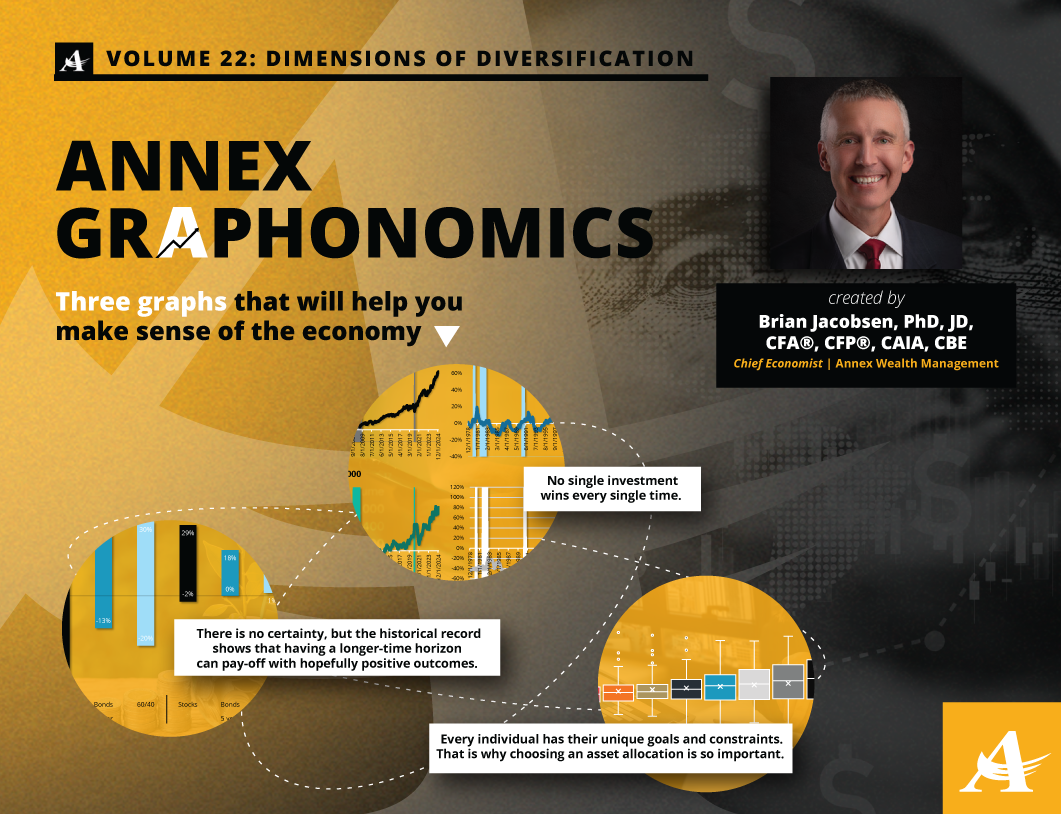

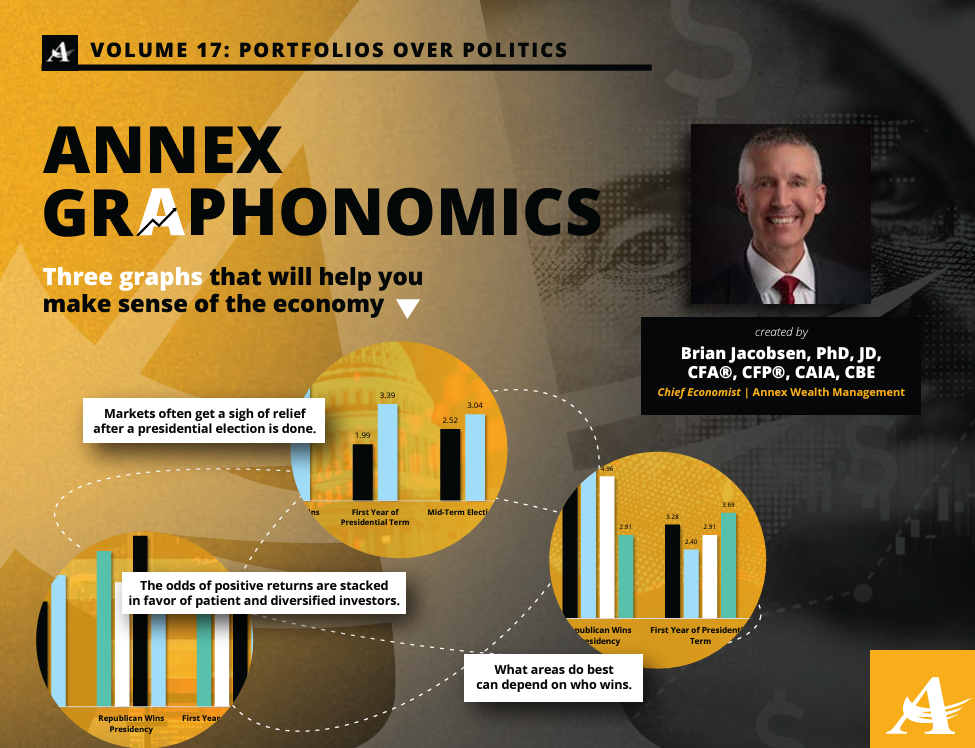

Graphonomics: Volume 17

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Election Rallies: Fact or Myth? 2) Post Election: Value & Growth Investments 3) When Different Parties Win

If you reach retirement age and haven’t saved enough, who is to blame? The retirement industry, yourself – or a little of both? Annex Wealth Management’s Director of Retirement Plan Services, Tom Parks, AIF®, CRPS™ discusses.

Instant Insight: Jobs & The Economic Outlook

Penetrating analysis from the Annex Wealth Management Investment Committee on breaking financial and market news.

Graphonomics: Volume 16

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Growth: The End Is Near 2) Inflation: Context Matters 3) Policy: Results May Vary

How To Look After Your Mental Health In Retirement

It’s important to not leave out a critical piece of the picture. Successful retirement takes a whole lot more than adequate financial planning.

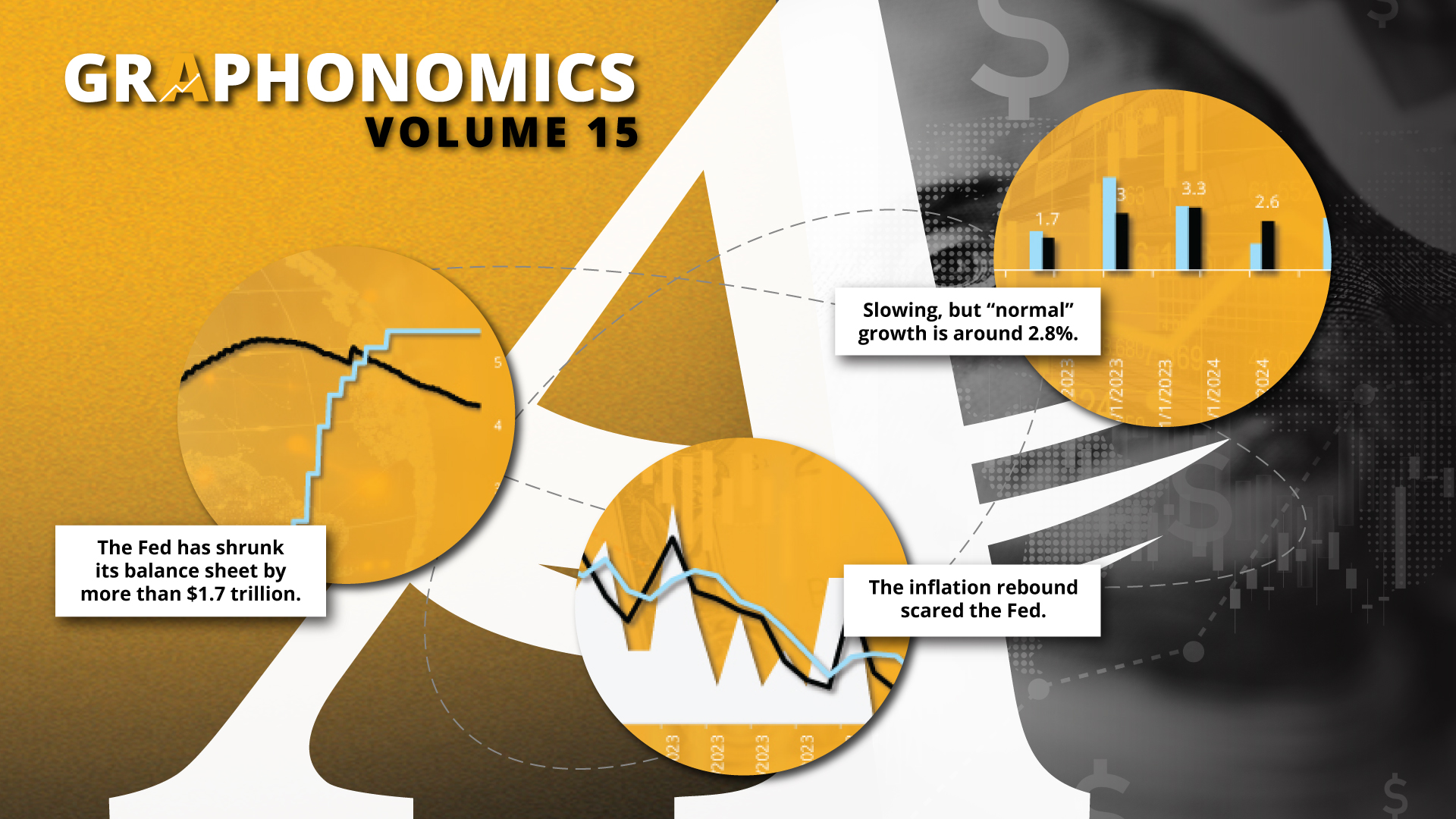

Graphonomics: Volume 15

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Growth: Slowing, But Normal 2) Inflation: Rebound 3) Policy: Shrinking Balance Sheet

The Hard Truth: Retirement Planning Requires Personal Responsibility

Want a comfortable retirement? Guess what – it’s your responsibility to make it happen.

Retirement Killers

What gets in the way of saving for retirement? Annex Wealth Management’s Suzy Lopez, CFP® discusses several retirement killers and how to prevent them.

7 Money Lies We Tell Ourselves

Everyone does it, one way or another. See if any of these lies sound familiar to you. And find out what kind of damage believing them can do to your finances. Amy Bremmer is here to discuss.

Steps To Selling A Business

For many business owners, their business is not only their largest asset, but their legacy. When selling a business, it’s important to have a solid plan in place. We’ll discuss the steps that need to be taken to maximize the sale of your business, as well as the kind of team you’ll need to ensure it goes smoothly.

6 Things You Might Not Want To Inherit

Certain assets can cause arguments between family members or may have hidden costs. Amy Kiiskila and Deanne Phillips discuss.

Reimagining Retirement: Why Turning 65 Isn’t What It Used To Be

More than 4 million baby boomers will turn 65 in 2024 — the largest number of people in U.S. history to reach this milestone in a single year. How are boomers reinventing aging and retirement? Keith Butler, JD is here to discuss.

Financial Planning For Widows: Year One Checklist

As you navigate the journey of losing a spouse, addressing the financial considerations that come with such a significant life change is crucial. In this segment, Alec and Deanne concentrate on what should happen during year one as a widow.

Graphonomics: Volume 13

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Growth: Slowing to a crawl 2) Inflation: An unclear target 3) Policy: Hurts from the bottom up

The Five Most Underrated Benefits Of 401k Plans

There are some benefits of investing in employer-sponsored retirement plans like 401(k), 403(b), and 457 accounts that aren’t well-known. Here’s a few underrated benefits you need to know.

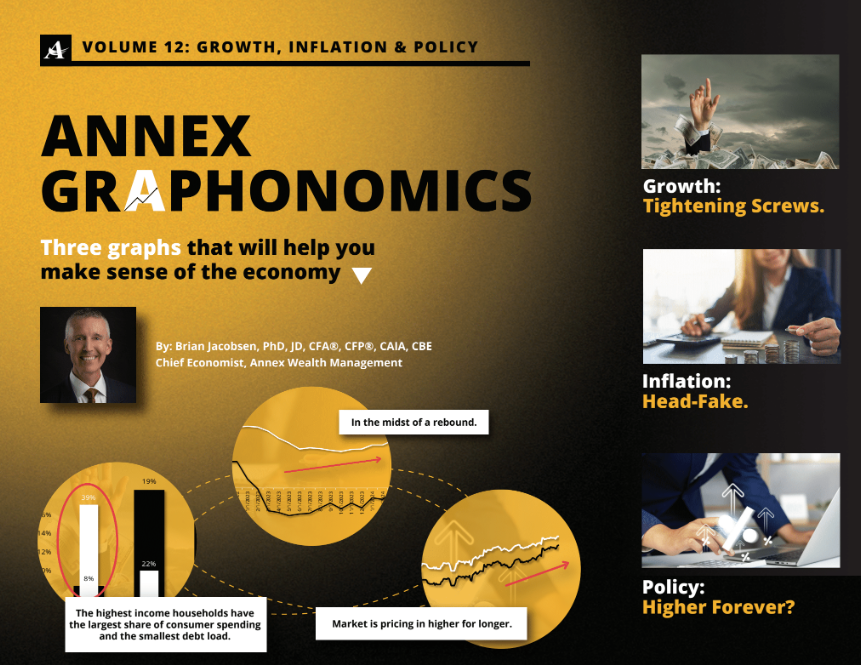

Graphonomics: Volume 12

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Growth: Tightening Screws. 2) Inflation: Head-Fake. 3) Policy: Higher Forever?

Safeguarding Against Inflation

Strategies for Wealth Preservation In An Environment of Elevated Inflation

Inflation is proving harder to defeat than some experts had expected, and the current environment of elevated inflation presents unique challenges – particularly for those nearing or already in retirement. Even if you’ve worked and accumulated a comfortable portfolio, navigating today’s inflationary landscape may still require strategic adjustments to your retirement plan.

Retirement Planning For Gen X

If you’re a member of Gen X, it may be time to increase focus and take some definitive steps towards your retirement goals. Annex Wealth Management’s Kyle Svetlik is here to talk about how to do just that.

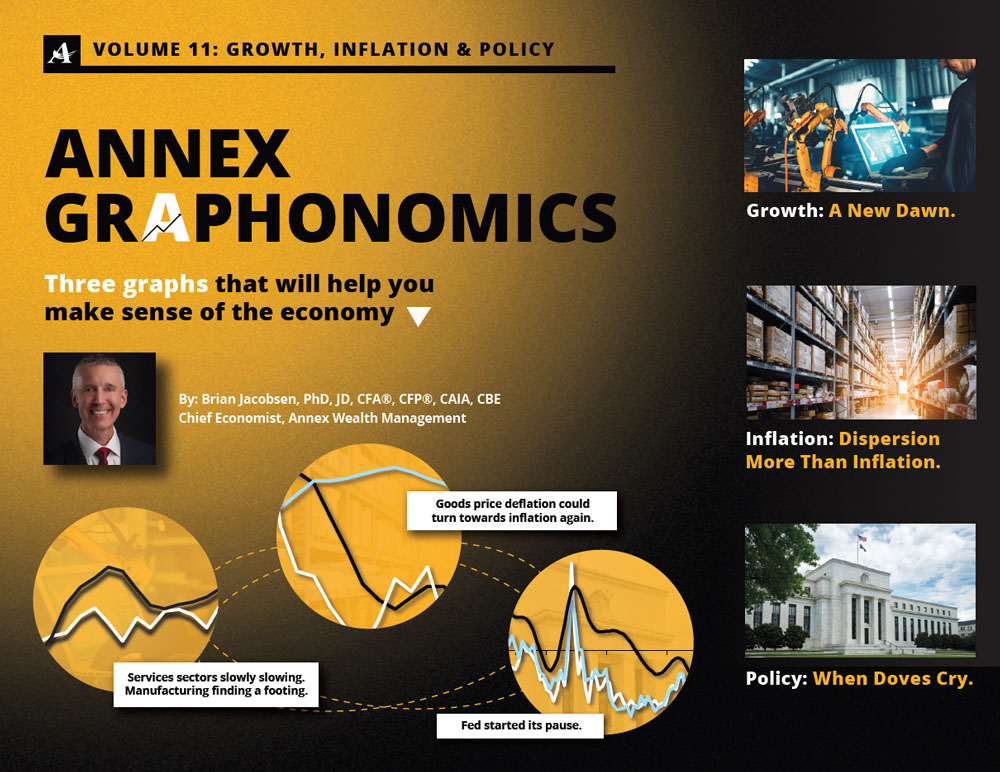

Graphonomics: Volume 11

3 Graphs that will help you make sense of the economy.

In this version, Graphonomics focuses on 1) Growth: A New Dawn 2) Inflation: Dispersion More Than Inflation 3) Policy: When Doves Cry

Video | Is Annex Wealth Management the Right Fit For You?

Ask yourself these 5 questions.

Video | How Does Your 401k Plan Stack Up To Others?

With 70 million Americans invested in 401ks*, it’s likely not all are all-stars. Annex Wealth Management’s Tom Parks gives a starting point to see how your 401k stacks up on things like the size of matching contributions, quality of investment choices, fees, and plan perks.

*401kspecialistmag.com/access-to-401ks-surges-past-70-million-in-2023-capitalize/

Video | Common Challenges Business Owners & Entrepreneurs Face

Director of Annex Private Client, Brandon Lehman, CFP®, AIF® is here to discuss some of the unique challenges business owners and entrepreneurs face, and how to overcome them.

Video | The Psychology of Spending In Retirement

You work your whole life to build a retirement savings. Then finally, it’s time to retire and spend it. Why is this transition so hard for so many?

According to a recent survey, most adults would prefer to remain in their home as they age – according to the same survey however, most adults are not prepared to do so. Annex Wealth Management’s Deanne Phillips, CFP®, CDFA®, ABFPsm discusses the questions you should be asking yourself as you age and are faced with the decision to downsize, upsize, or stay put.

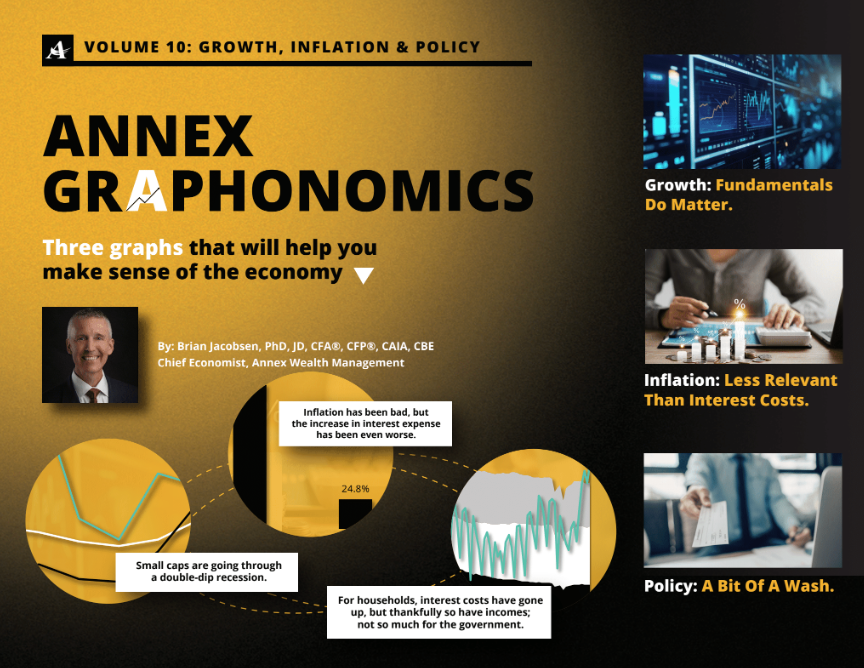

Graphonomics: Volume 10

3 Graphs that will help you make sense of the economy

In this version, Graphonomics focuses on 1) Growth: Fundamentals Do Matter 2) Inflation: Less Relevant Than Internet Costs 3) Policy: A Bit Of A Wash

Video | The Value of an Advisor

Every year, Russell Investments releases a study articulating the value of an advisor, making sure to calibrate their formula based on contributing factors. Annex Wealth Management’s Brandon Lehman discusses the four critical areas of value, explaining how crucial a fee-only fiduciary advisor can be.

Video | Have You Considered Part-Time Retirement?

You might imagine retirement as the last day you go into the office, but what if it meant simply reducing hours, moving to a consulting position, or starting a “fun” job that follows your passions?

Part-time retirement provides balance and possibilities for retirees wanting to stay busy. Annex Wealth Management’s Suzy Lopez, CFP® is here to discuss.

Video | The 4 Phases of Retirement

Prepare for a fulfilling, purposeful life in retirement.

Annex Wealth Management’s Chief Growth Officer, Mark Beck explores how the journey of retirement unfolds, the patterns of people’s experience in retirement, and the keys to thriving along the way.

Video | Estate Planning Mistakes To Avoid When Getting Remarried

Don’t make these common errors when getting remarried.

Video | Planning For Life In Retirement

Planning for retirement involves more than just financial considerations. Annex Wealth Management’s Keith Butler, JD is here to discuss why emotional health and personal fulfillment should be part of your retirement portfolio.

Video | How To Lead Your Adult Children To Financial Independence

Amy Bremmer, MBA, CFP®, Wealth Manager at Annex Wealth Management, is here to discuss why you might want to rethink financially supporting your adult children – or at least begin to set boundaries.

Video | Navigating Gray Divorce

Gray Divorce is a growing trend that can have serious financial implications. Annex Wealth Management’s Deanne Phillips, CFP®, CDFA®, ABFPsm covers what a Gray Divorce is and how to navigate one financially.

13 Millionaire Don’ts

Financial Planning Blunders Millionaires Should Avoid

Here are “13 Millionaire Don’ts” – pitfalls that millionaires should avoid as they seek to secure and sustain their financial prosperity.

Graphonomics: Volume 9

3 Graphs that will help you make sense of the economy

In this version, Graphonomics focuses on 1) Growth: American Exceptionalism 2) Inflation: Almost Home 3) Policy: In A Good Place

Video | Inside Annex: The Investment Committee

Investment Team Manager, Matt Morzy, CFP® and Chief Economist, Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE gives a look inside Annex Wealth Management’s Investment Committee.

Video | Understanding Spousal Social Security Benefits

We’re all familiar with Social Security—but what about Spousal Social Security? Here to talk about it, two members of our Financial Planning Team; Arabella Parins and Eric Strom, CFP®, EA.

Video | Inheriting Money: The Do’s & Don’ts

It’s a loss when someone passes – but when they took the time to do things correctly with a well-constructed estate plan, it makes the distribution of assets far easier. If you are on the list for some of those assets, there are some do’s and don’ts. Annex Wealth Management’s Alec Durand, JD is here to discuss.

Video | HENRYs (High Earners, Not Rich Yet)

Annex Wealth Management’s Jeff Stanich defines HENRYs and discusses what to do get on track financially if you are one.

Video | Do Houses Make Terrible Wealth Transfer Vehicles?

Home may be where the heart is, but after it’s inherited, it’s where heirs must manage upkeep and deal with family conflicts related to what to do with it. What’s a better way? Annex Wealth Management’s Amy Kiiskila, JD, CFP®, CPA, CLU® is here to discuss.

Corporate Transparency Act: How Seriously Should You Take Beneficial Ownership Reporting?

Starting January 1, 2024, many companies and entities in the U.S. will need to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

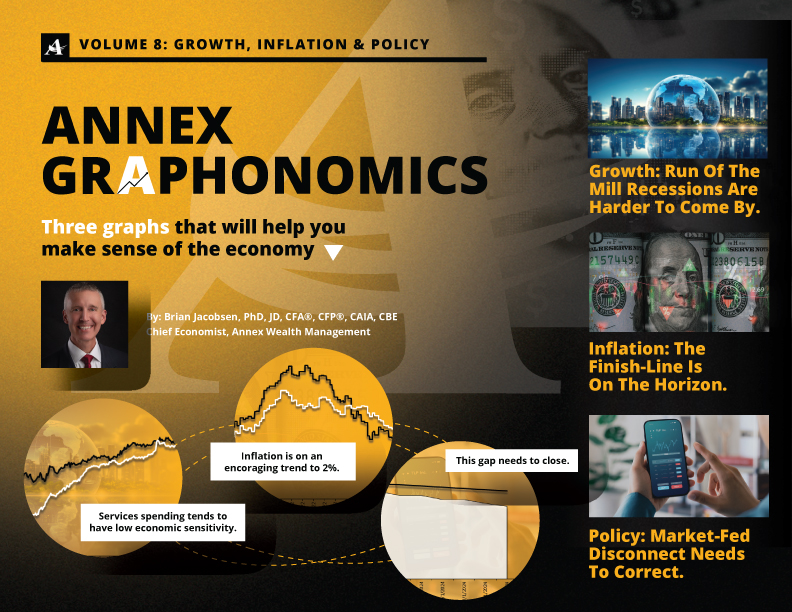

Graphonomics: Volume 8

3 Charts Designed To Make Sense Of The Markets & Economy

In this version, Graphonomics focuses on 1) Growth: Run Of The Mill Recessions Are Harder To Come By. 2) Inflation: The Finish-Line Is On The Horizon. 3) Policy: Market-Fed Disconnect Needs To Correct.

3 Potentially Great Tax Strategies For Executives

Three tax strategies that might significantly benefit executives – approaches that may not only minimize tax liabilities, but also provide opportunities for long-term wealth creation.