Investment Management

Annex Wealth Management’s investment decisions are guided by its Investment Policy Committee. The Investment Policy Committee meets regularly to monitor, report and discuss investment decisions.

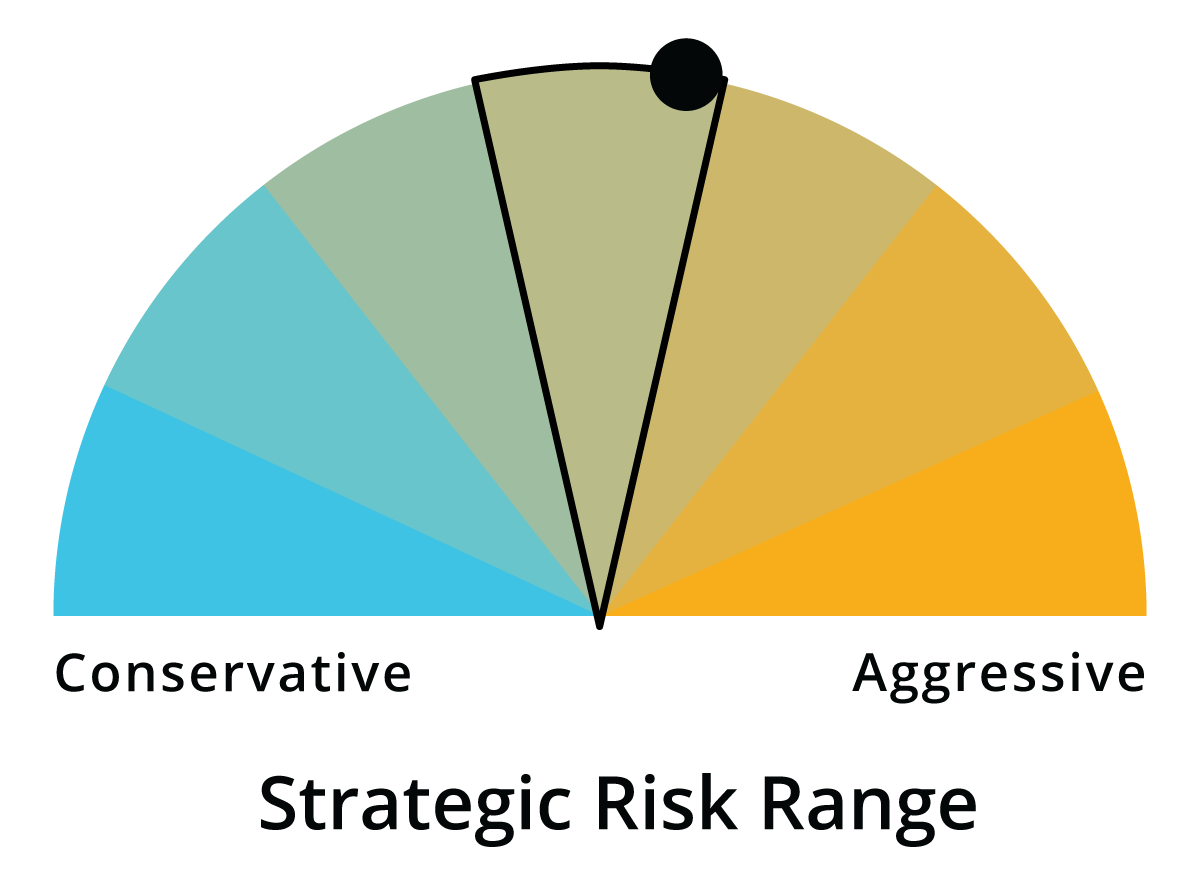

Annex Wealth Management builds diversified, disciplined portfolios for specific risk categories ranging from conservative to aggressive growth and/or specific portfolio objectives such as income, capital preservation, or capital appreciation.

INVESTMENT COMMITTEE

Dave Spano, CFP®

Chief Executive Officer

Derek V.W. Felske, CFA®

Chief Investment Officer

Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE

Chief Economic Strategist

Mark Beck

Chief Growth Officer

Steve Dryer, MBA

Chief Operating Officer

Anthony Mlachnik, MBA, CIMA®, BFA

Senior Wealth Advisor

Jason Cooper, CFA®

Director Of Equity Research

Jack DeRoche

Manager of Investment Operations

Kiya Adam

Trader

Clayton Beilfuss

Trader

Nick Hillstrom

Trader

Mark Schaefer

Trader

Jamie Watkins

Trader

Jacob Johnson

Associate Research Analyst

WHAT YOU GET

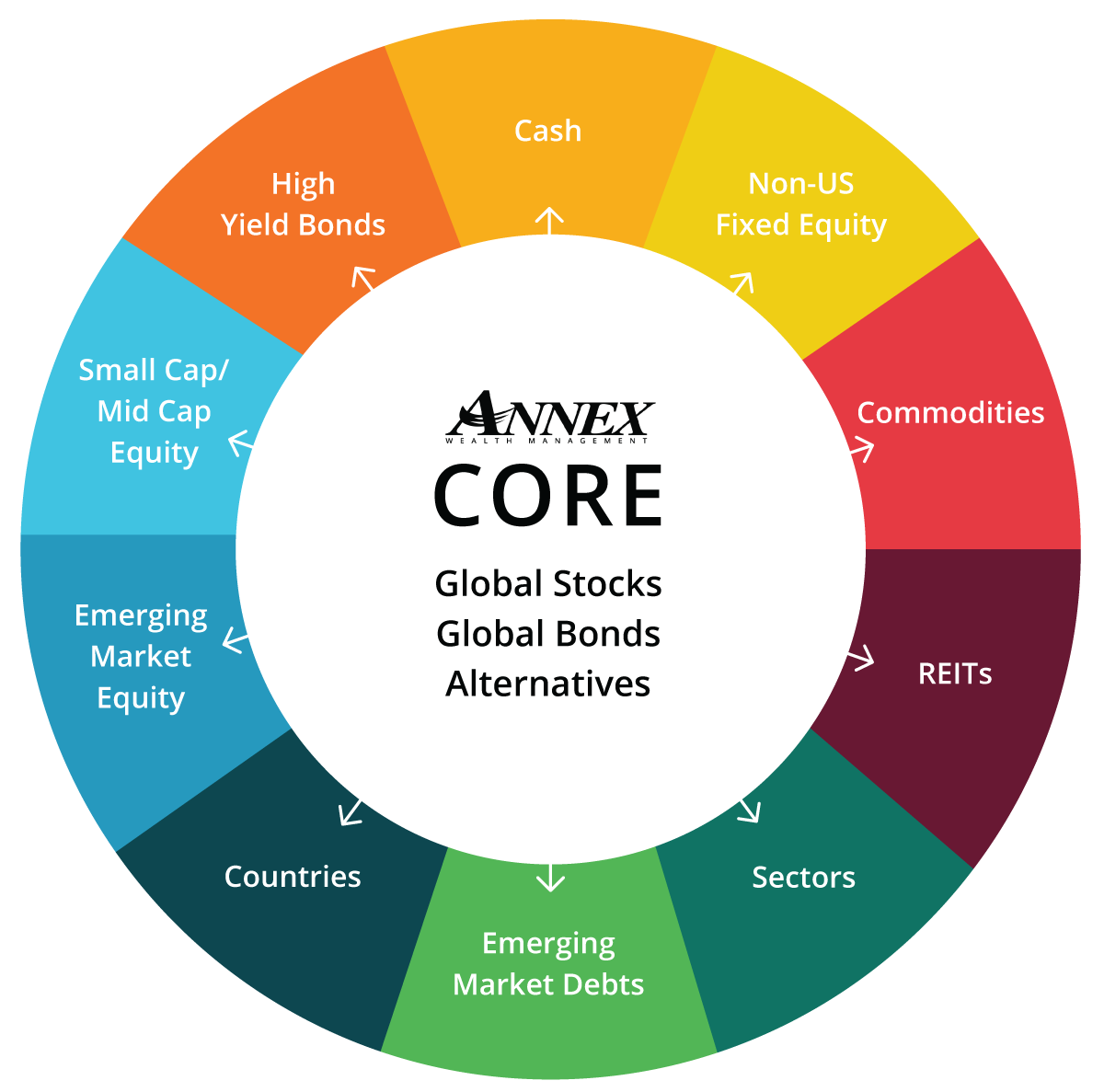

Annex Wealth Management employs a Core and Tactical Investment Strategy. We construct globally diversified portfolios using forward-looking asset allocation guidelines and employ tactical investment strategies around the core, where we seek to balance risks, identify opportunities and account for changes in economic and market cycles.

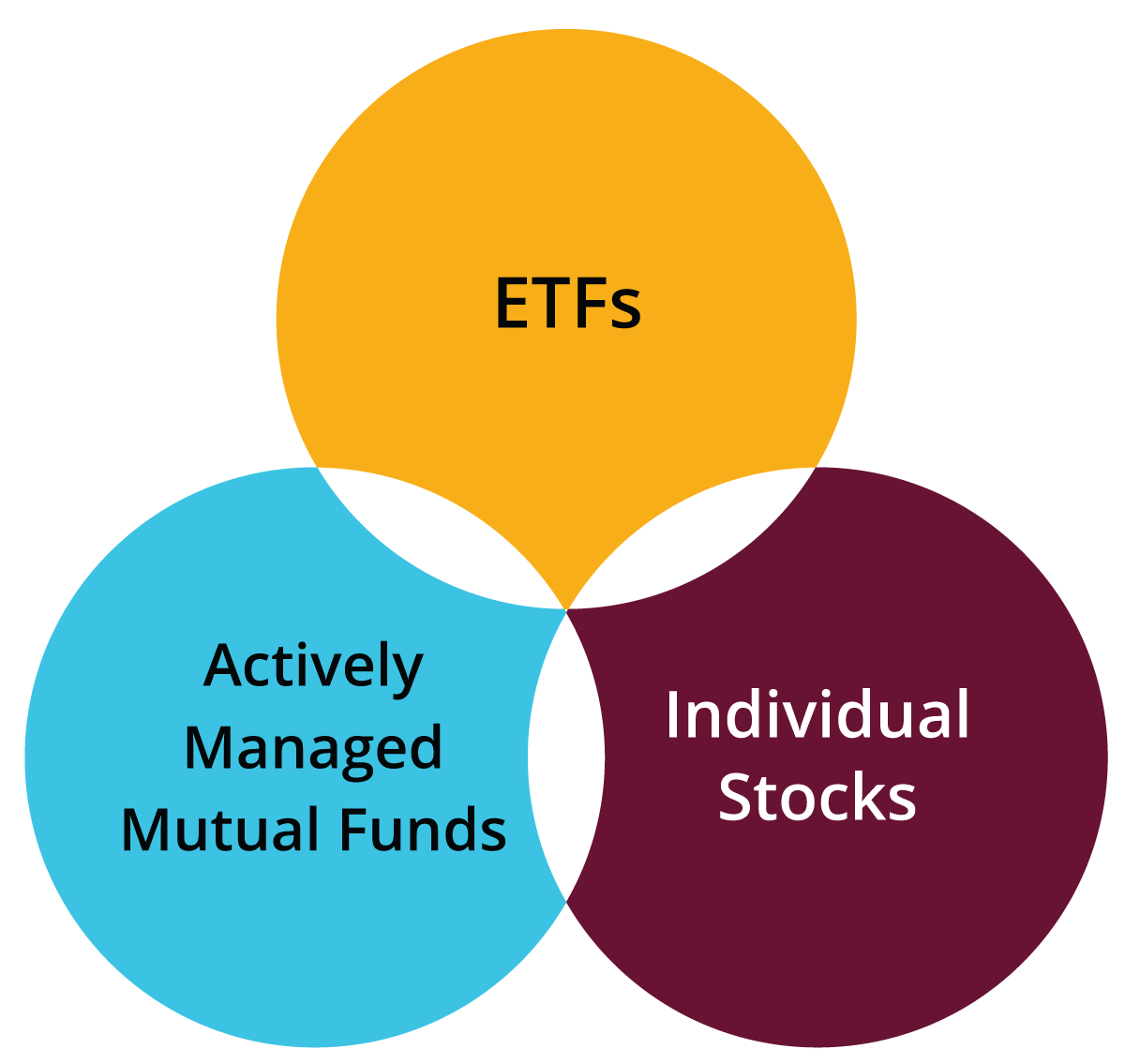

Portfolios are constructed from a combination of actively managed mutual funds, exchange-traded funds (ETFs), and individual stocks.

We will use actively managed mutual funds when we’ve identified active managers that we believe can outperform comparable index funds on a risk-adjusted basis.

We prefer mutual funds for asset classes that are less efficient such as international stocks or high-yield bonds. The higher expense ratio charged by mutual funds is justified by their opportunity to outperform comparable ETFs or index mutual funds.

We will use passive ETFs for asset classes that are very efficient, where it doesn’t make sense to pay a higher expense for an actively managed fund.

- Using our technology, we gather data from clients and then analyze it to assign clients a risk score

- Risk scores are then translated into an IPS range consistent with our model portfolios

- Clients are then placed into a portfolio consistent with their range, from conservative to moderate to aggressive

Featured Insights

OUR LATEST INSIGHTS

Week In Review

Annex Wealth Management strongly believes in frequent and meaningful communication with our clients. We regularly provide exclusive insights from our Investment Committee to help our clients stay on top of the issues impacting their accounts.

DISCLAIMER: Annex Wealth Management is not a law firm and our employees are not acting as your attorney. We do not provide legal advice or draft legal documents. The information contained on this site is general and should not be construed or used as a substitute for legal advice. The law differs in each legal jurisdiction and may be interpreted or applied differently depending on your location or unique situation. You are encouraged to consult with your attorney for legal advice and services.

Fill Out The Get Started Form