Annex Wealth Management’s investment decisions are guided by its Investment Committee. The Investment Committee meets regularly to monitor, report, and discuss investment decisions.

Our approach to portfolio construction and investment management emphasizes serving as a client-first fiduciary by making decisions through collaborative specialization based on the best evidence from a synthesis of top-down and bottom-up perspectives.

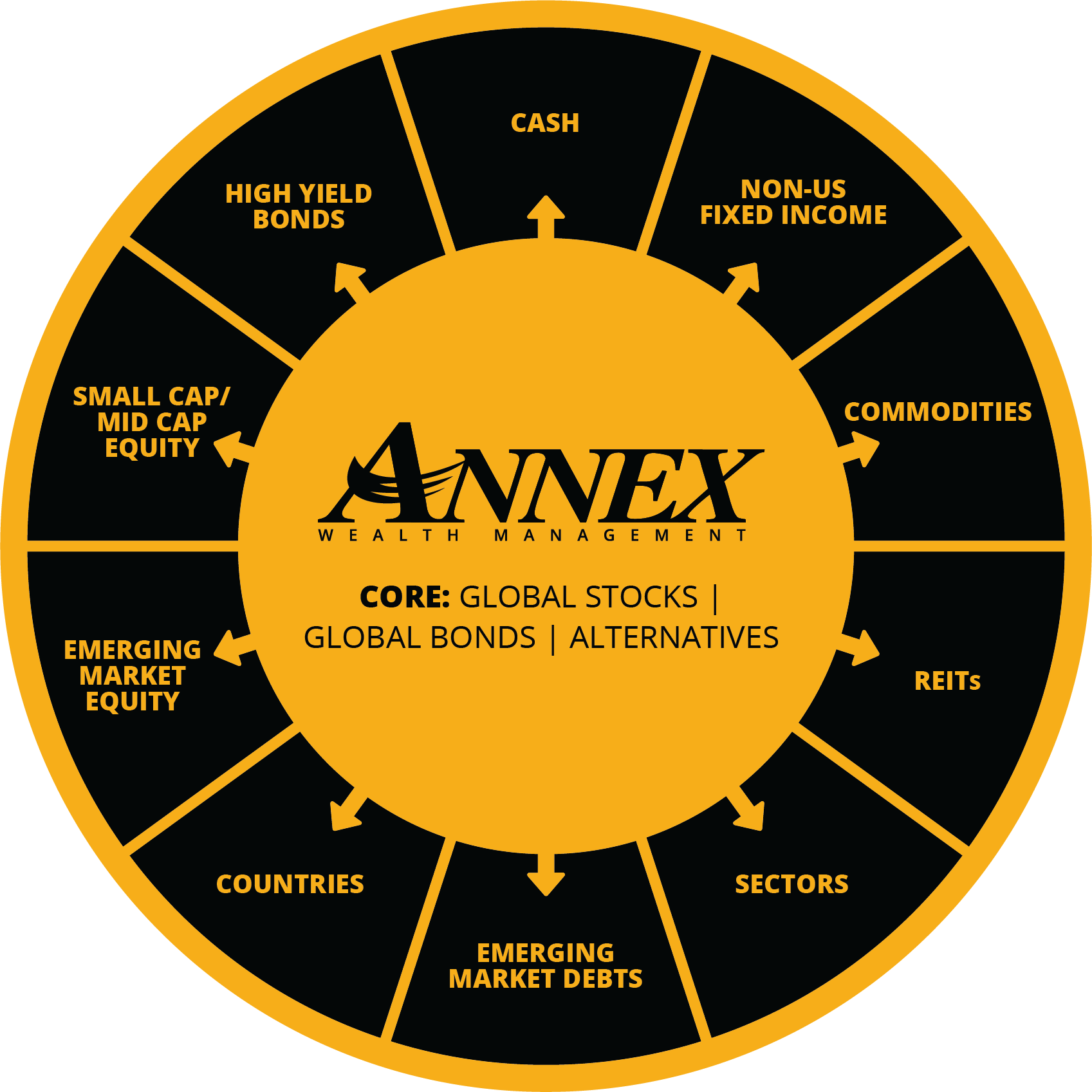

Core & Tactical Allocation

Annex Wealth Management employs a Core and Tactical Investment Strategy. We construct forward-looking globally diversified portfolios using asset allocation guidelines while employing tactical investment strategies around the core for proactive management, identifying risks and opportunities and accounting for changes in economic and market conditions.

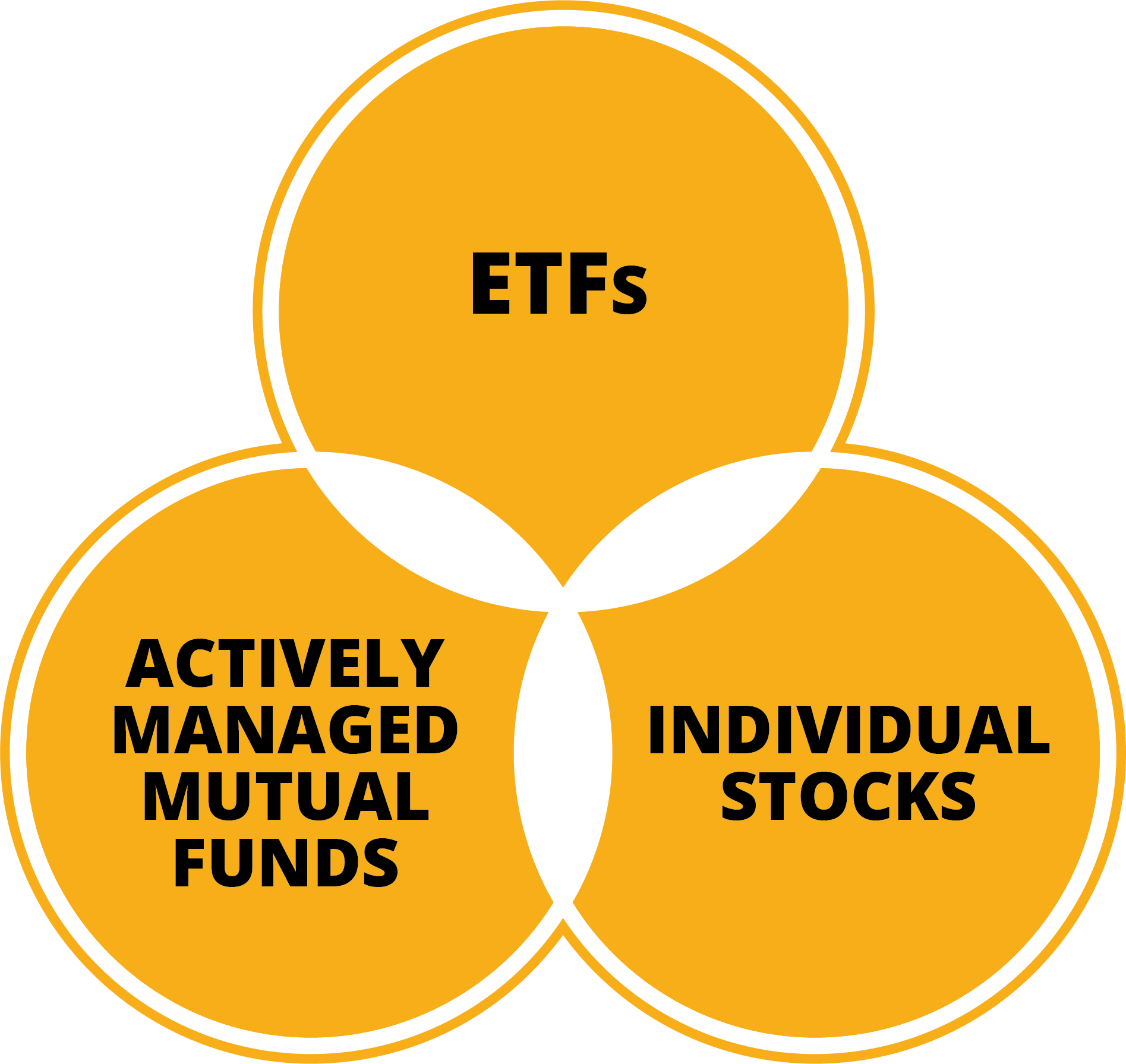

Customized Investment Selection

Portfolios are constructed from a combination of actively managed mutual funds, exchange-traded funds (ETFs), and individual stocks.

We will use actively managed mutual funds when we’ve identified active managers that we believe can outperform comparable index funds on a risk-adjusted basis.

We prefer mutual funds for asset classes that are less efficient such as international stocks or high-yield bonds. The higher expense ratio charged by mutual funds is justified by their opportunity to outperform comparable ETFs or index mutual funds.

We will use passive ETFs for asset classes that are very efficient, where it doesn’t make sense to pay a higher expense for an actively managed fund.

Customized Asset Allocation

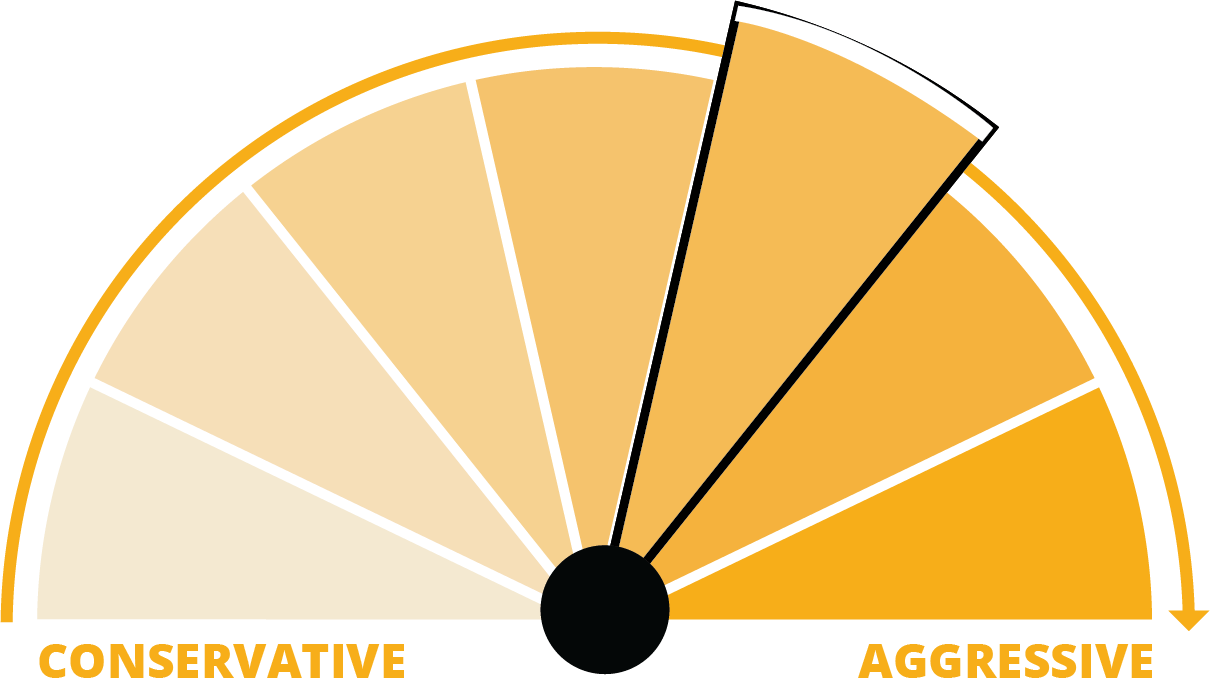

Using technology, we gather data from clients and then analyze it to assign clients a risk score. Risk scores are then translated into an IPS range consistent with our model portfolios. Clients are then placed into a portfolio consistent with their range, from conservative to moderate to aggressive.

An IPS is a formal agreement that serves as a strategic guide for managing investments by clearly stating:

- Investment Objectives: What the client aims to achieve financially.

- Asset Allocation Strategy: The mix of equities, fixed income, and cash tailored to the client’s goals and risk tolerance.

- Risk Tolerance and Time Horizon: How much volatility the client is comfortable with and over what period.

- Liquidity Needs: How much of the portfolio should be readily accessible.

This document helps ensure that the portfolio remains aligned with the client’s long-term goals.

Annex Wealth Management is not a law firm and our employees are not acting as your attorney. We do not provide legal advice or draft legal documents. The information contained on this site is general and should not be construed or used as a substitute for legal advice. The law differs in each legal jurisdiction and may be interpreted or applied differently depending on your location or unique situation. You are encouraged to consult with your attorney for legal advice and services.

Sign Up For The Axiom®